On March 30, Meta (formerly Facebook) announced the establishment of a new engineering center in Canada, aiming to build a metaverse to drive a new generation of immersive online social experiences. Headquartered in Toronto, the engineering centre is expected to employ as many as 2,500 people. Meta pointed out that the Canadian Engineering Center's business focuses on engineering research and development, and is expected to expand to AR/VR content and Meta technology development in the future. (iMore)

2022年3月31日星期四

SEC: Crypto asset custodians should treat them as liabilities and disclose risks

The U.S. Securities and Exchange Commission (SEC) said on Thursday that U.S. public companies and others that provide services as custodians of crypto assets should treat those assets as liabilities and disclose the risks associated with those assets to investors. (CoinDesk)

Bank of Spain Deputy Governor: Widespread Use of Cryptocurrencies Could Bring Various Risks

In golden financial news, Margarita Delgado, deputy governor of Spain’s central bank, said at an event called “Climate of Change” hosted by PricewaterhouseCoopers that 12% of Spanish citizens are expected to hold cryptocurrencies, and the continued and Widespread use could pose various risks to these individuals. Decentralized finance can lead to over-leverage and payment problems if cryptocurrency holders don’t know enough about the cryptocurrency. Furthermore, its high volatility could have a contagious effect on other markets as panic and overreaction can be transferred to other trading environments. Finally, Delgado said it was necessary to examine whether these investors were fully aware of the risks they faced, or were simply driven by sky-high revaluation expectations. (news.bitcoin)

2022年3月30日星期三

Ukrainian startup Hacken launches cyberattack on Russia

Ukrainian startup Hacken launched a cyber attack on Russia, according to Golden Finance. During the day, Dmytro Budorin, CEO of Ukrainian startup Hacken, and his team conduct cybersecurity audits of cryptocurrency protocols and exchanges. After get off work at night, the company turned into a group of hacker activists wreaking havoc on the Russian internet landscape. The Russian-Ukrainian war has inspired a global army of hacker networks to carry out digital retaliation against Russia. Among them is Hacken's 70 employees, who juggle cybersecurity operations, support for fellow Ukrainians on the ground, and cyberattacks against Russia. (CoinDesk)

The Ukrainian war has a great impact, and the agency says it will reshape the bulk market!

The Ukrainian war could change commodity markets if lessons from the 1970s are applied to the current geopolitical situation. Prominent long-term consequences include demand destruction and new energy independence goals.

Prominent long-term consequences include demand destruction and new energy independence goals . "Rising prices could lead to a degree of demand destruction," Clancy said. "In the future, a renewed focus on energy independence in Europe and elsewhere will have a long-term impact on supply and demand for commodities."

The current situation is distinct from the oil price shock of the 1970s. of similarities.

From October 1973 to March 1974, OPEC stopped exporting oil to many Western countries as punishment for its aid to Israel during the Yom Kippur War. Not only oil prices soared at the time, but other commodity prices also soared, as higher energy prices led to higher production costs. "We're seeing something similar this time around with the Ukraine war in terms of the speed and scale of commodity price increases," Clancy said. The

recent surge in oil prices above $100 a barrel is largely due to the long-term impact on supply and other commodities. concerns about impact. This is very similar to the situation in the 1970s.

A striking similarity between the 1973/74 oil price shock and the Ukraine war is their impact on energy policy . In 1973-74, the U.S. responded to the sudden OPEC production cuts by accelerating energy independence efforts, and this time around, we're seeing something similar across the West. The European Commission, for example, has announced plans to free Europe from Russia's fossil fuels by 2030, which could accelerate the transition to renewable energy in the years ahead.

Another similarity is that,Existing supply is insufficient to make up for the current supply disruption . “At the time, the OPEC embargo came at a time when U.S. oil producers were already close to capacity. Although shale has boomed since then, U.S. drilling activity has yet to show an imminent surge in production.”

So far, OPEC has rejected demands to make up the shortfall in Russian supply and ramp up production quickly.

“Commodity prices are likely to remain high for some time, like the initial shock in 1973. High oil prices may start to have an increasingly negative impact on demand, but it’s hard to imagine that this will offset the impact of reduced supply on prices. Upside pressure. However, it is too early to completely rule out a surge in shale production as investment could still grow significantly in the coming months. While OPEC's stance has been firm so far, it is taking advantage of its There is increasing pressure on a lot of spare capacity.”

2022年3月29日星期二

OPEC+ still reluctant to significantly increase output, UAE backs Russia

Russia will always be a member of OPEC+, the UAE energy minister insists, despite governments shunning Moscow over the war in Ukraine . No country can match Russia's energy output, Suhail Al Mazrouei said on Monday. He said: "Russia will always be a member of this organization, and we need to respect them." Based on OPEC+'s firm attitude towards Russia, the influence of Russian oil on international oil prices is indispensable, and the market must pay close attention to the direction of the Russia-Ukraine war.

The UAE energy and infrastructure minister insisted that Russia will always be a member of OPEC + , even as governments around the world shun the oil exporter over the Ukraine war.

Suhail Al Mazrouei, the former chairman of the oil union, said on Monday that no country can match Russia's energy production, arguing that politics should not distract from the group's efforts to manage energy markets . " Russia will always be part of this group and we need to respect them ," he told

the Atlantic Council's sixth annual Global Energy Forum in Dubai . "OPEC+, when they talk to us, they need to Talk to us, including Russia ." He was referring to the group's negotiations with energy importers. The United States , Europe and Japan have called on producers to do more to deal with record-high oil prices caused by the war in Ukraine and persistent supply shortages. However, Al Mazrouei said Rosneft will play a key role in making this happen . His comments came as Western allies expressed concern that energy imports from Russia are indirectly boosting Russian President Vladimir Putin's oil and gas revenues. “Who can replace Russia today? I can’t think of any country that can replace 10 million barrels of oil in one, two, three, four or even 10 years . It’s not realistic.” OPEC+ led by Saudi Arabia and Russia Ability to increase oil production and reduce crude oil prices, which have now jumped to 100 per barrel

more than US dollars .

"We agree with their goal of trying to stabilize the market and balance the market," Al Mazrouei said. "But you can't do that. You can't do it by sanctioning an oil that you can't replace - unless you want prices to keep going higher ."

OPEC Ministers from non-OPEC and non-OPEC countries are scheduled to hold a video conference on Thursday to determine the next phase of production policy.

G7 energy ministers said OPEC would play a key role in easing market tensions, with the influential alliance facing new pressure to increase oil supplies. They said in a joint statement on March 10: "We call on oil and gas producers to act responsibly and to review their ability to increase supply to the international market, especially where production has not yet reached full capacity, OPEC plays an important role. It will help ease tensions." The G7 includes the UK, US, Canada, Japan, Germany, France and Italy.

OPEC+ is unwinding record output cuts of around 10 million bpd. The historic production cut was implemented in April 2020 to help the energy market recover after the coronavirus hit crude demand.

Most recently, the group increased production by 400,000 barrels per day per month. The energy union has persevered despite continued pressure from major consuming nations to boost supply to cool prices and help the economy recover .

OPEC alone accounts for about 40% of global oil supply.

Based on OPEC+'s firm attitude towards Russia, it can be found that Russia has an irreplaceable position and role in the OPEC+ alliance. Therefore, the influence of Russian oil on international oil prices is indispensable, and the market must pay close attention to the trend of the Russia-Ukraine war.

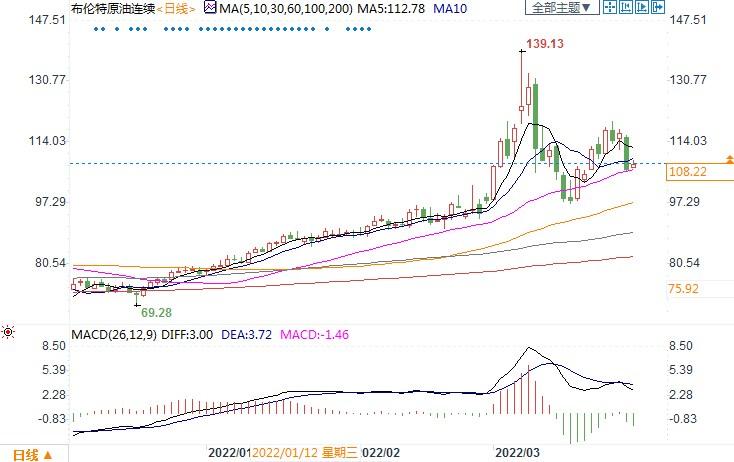

Brent crude oil daily chart

at 13:28 Beijing time on March 29, Brent crude oilContinuous at $108.35 a barrel

It is difficult for the United States to increase oil production, and there are three reasons behind the decryption!

There's no sign that oil prices will pull back anytime soon, but that doesn't mean there's going to be a new wave of production. U.S. oil producers are struggling with rising costs caused by inflation, labor shortages and investor sentiment, all of which have affected their ability to ramp up output.

May Brent crude oil (CO1:COM) closed at $ 120.65 a barrel, a weekly gain of 12%, while May WTI crude oil (CL1:COM) closed at $113.90 a barrel, a weekly gain of 10.5%.

The attacks come at a time when supply risk is higher than it has been in years, and Phil Flynn of Price Futures Group said the gap between supply and demand will only get worse.

Meanwhile, U.S. Natural Gas (NG1:COM) surged 15% over the week to $5.571/MMBtu on news that the U.S. will increase LNG shipments to Europe to reduce Europe's reliance on Russian gas driven by optimism.

The oil and gas market is markedly optimistic, and with the global energy crisis and high fuel prices, uncharacteristically encouraged by a Biden administration, you would think that U.S. producers would open the oil and gas valve and scramble to make money. Still, more work appears to be needed to get chronically struggling U.S. producers to ramp up output. This situation is mainly due to the following three reasons:

hard lesson

A recent survey by the Federal Reserve Bank of Dallas found that major oil companies intend to grow crude output by an average of just 6% a year, while smaller oil companies plan to grow 15%. Nearly a third (29%) of respondents said economic growth would not depend on oil prices. More than half of respondents attributed the slowdown to investor pressure to maintain capital discipline , suggesting they have learned some hard lessons over the past few years.

cost rise

Another major reason why big oil companies are only looking to ramp up production modestly is inflation and the consequent rise in costs .

According to the report, several indicators of oil and gas business activity in the first quarter have reached record highs. Service prices, oilfield service companies' operating profits and industry labor metrics all hit six-year highs in a Dallas Fed survey.

Unfortunately, input costs for oilfield service companies, as well as E&P companies for discovering, developing resources and operating leases are at record highs. Costs for oilfield services companies and E&P companies rose for the fifth consecutive quarter, as did lease operating expenses, discovery and development costs for E&P companies. The input cost index for oilfield services companies hit a record high.

Ryan Lance of ConocoPhillips said earlier this month: “We are facing the same inflation and supply chain issues as other manufacturers in the U.S. A range of commodities and categories from land, trucking and chemicals imported from Europe All of these supply chain issues are impacting our ability to do so.” Drilling new oil now will not immediately ease the rise in oil prices, which will continue globally for at least a year, he said.

Vicki Hollub, CEO of Occidental Petroleum, also said: "We have never faced a situation where we need to increase production, not only in our industry, but the actual supply chain of every industry in the world is affected by the epidemic, and the situation in this industry is very serious. "

labor shortage

There are rigs, but no employees . However, oil companies must understand that oilfield services, especially onshore drilling contractors, must pay a livable fee to justify the large capital costs required to operate, upgrade and equip modern onshore rigs. Lack of staff, delivery, and the cost of piping, frac sand, cement, etc., are all business concerns. It will take quite a while to achieve growth. And investor pressure.

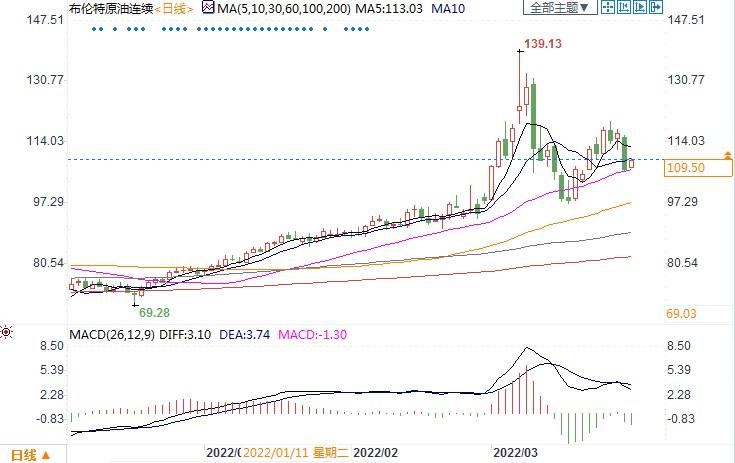

Brent crude oil daily chart

at 15:30 on March 29, Beijing time, Brent crude oil continuously reported $109.50 per barrel

2022年3月28日星期一

U.S. WTI spot oil prices fell on Monday, fluctuating between $109-110

Saudi Arabia has warned that crude supplies are at risk and that it may struggle to raise output. OPEC is scheduled to meet on Thursday to discuss the market outlook and whether it should raise output further.

Oil prices rallied in volatility on Friday, but earlier this week saw bulls meet their rivals and oil prices fell sharply in open trade. The spot price of U.S. West Texas Intermediate crude (WTI) was around $ 109.4 .

The tightening of measures against Omicron reportedly weighed on the demand outlook for the oil market. Meanwhile, crude oil prices rose sharply in the previous week as the war in Ukraine continued to roil markets. However, more supply disruptions hit the market last week. The storm damaged facilities at the Caspian Pipeline Union Marine Terminal, causing disruptions in loading. Initial expectations were that exports could fall by 1 million bpd.

"A Saudi oil storage facility was hit by an intensive drone attack by Yemen's Houthi rebels," ANZ analysts explained on Friday. The alleged damage to Aramco's facilities has caused some short-term operational disruptions . Saudi Arabia has previously warned that crude supplies are at risk and that it may struggle to raise output. OPEC is scheduled to meet on Thursday to discuss the market outlook and whether it should raise output further.

On U.S. soil, the Biden administration is considering another release of oil from the Strategic Petroleum Reserve, which could surpass the 30 million barrels sold earlier this month,media reported. In total, the United States and other members of the International Energy Agency (IEA) have released about 60 million barrels of oil reserves. Natasha Kaneva, head of commodities

research at JPMorgan , said: "They definitely have the ability to do more -- IEA members have about 1.5 billion barrels of SPR stockpiles. Anyway, that's the whole idea of SPR , to provide relief in an emergency." Continuous daily chart of crude oil US crude oil at 14:07 on March 28, Beijing time

Continuous at $109.63 a barrel

Spot gold fell sharply, Russia and Ukraine opened new peace talks, and this data must be paid attention to this week

Spot gold fell by more than 1.5% on Monday (March 28), and the market expected progress in the Russia-Ukraine peace talks this week, weakening the safe-haven charm of gold. In addition, a higher dollar index put pressure on gold prices. If the U.S. March nonfarm payrolls data due out this week is much higher than forecast, it is expected to strengthen the case for the Fed to raise interest rates by 50 basis points in May.

On Monday (March 28), spot gold fell by more than 1.5%, and the market expects that the peace talks between Russia and Ukraine may progress this week, weakening the safe-haven charm of gold. In addition , a higher dollar index put pressure on gold prices.

Russia, Ukraine prepare for talks in Turkey

Peace talks between Russia and Ukraine could start in Turkey on Tuesday, the Kremlin said on Monday, saying it was important that the talks would take place face-to-face despite little progress so far.

In a call with Putin on Sunday (March 27), Erdogan agreed to talks in Istanbul this week and called for a ceasefire and improved humanitarian conditions, Turkish President Recep Tayyip Erdogan's office said. Negotiators from Ukraine and Russia confirmed face-to-face talks would take place.

Ukrainian President Volodymyr Zelensky said on Sunday that Ukraine was willing to become neutral and compromise on the status of the eastern Donbas region as part of the peace deal. But another senior Ukrainian official accused Russia of aiming to divide the country in two.

A local leader of the self-styled Luhansk People's Republic said on Sunday that the region could soon hold a referendum on joining Russia. Oleg Nikolenko, a spokesman for the Ukrainian foreign ministry, dismissed claims of any referendum in eastern Ukraine.

If this week's Russia-Ukraine peace talks can make progress, gold is likely to fall further sharply in the short term, but given that sanctions against Russia are difficult to lift in the short term, gold prices are unlikely to fall below the previous low of $1,895.

Hard to say no to Russian energy

The European Central Bank 's stance of not rushing to raise interest rates may be tested when preliminary euro zone . Eurozone inflation is already at an all-time high of 5.9% and could hit 7% in the coming months. Given the ECB's target of 2 percent, it is not surprising that some officials are urging one or even two rate hikes this year.

Sanctioning Russian energy, as the US and UK have done, is one of the most powerful levers the EU can take. But OPEC has warned that the oil embargo could hurt consumers.

As pressure builds to announce the ban, a new twist has emerged - Russian President Vladimir Putin's request for "unfriendly" countries to buy gas in rubles has raised more concerns about Europe's energy shortage.

Europe relies on Russia for 40% of its natural gas supply, and soaring fuel prices have left Europe struggling. The debate over whether Europe can completely get rid of its dependence on Russian energy is causing anxiety among all parties and will limit the downside of gold.

Markets brace for Fed's more aggressive rate hikes

Important events that may affect the market this week are the U.S. March non-farm payrolls data to be released on Friday (April 1) to judge whether the U.S. economy is strong enough to respond to the Federal Reserve’s sharp interest rate hikes.

Economists polled expected 450,000 new jobs, down from a surge of 678,000 in February. If the actual data is much higher than forecast, it is expected to strengthen the case for the Fed to raise interest rates by 50 basis points in May. After all, Fed Chairman Jerome Powell has signaled his readiness to take more aggressive action if necessary.

Given that the market is already bracing for aggressive rate hikes this year, the impact of the non-farm payrolls is likely to be small. The USD short-term risk remains to the upside, but if we see any negative economic news, the USD could also see some correction.

Spot gold is expected to fall to $1922

On the daily line, the price of gold may start an upward ((iii)) wave trend from $1,895. On the hourly chart, the price of gold may start a retracement ii wave trend from $1966, falling below the 50% Fibonacci retracement level of the i wave at $1930, and is expected to test the 61.8% Fibonacci retracement level at $1922. Wave ii and wave i are both sub-waves of the up (i) wave started from $1895, (i) is the sub-wave of the up ((iii)) wave that also started from $1895, and the ((iii)) wave is It is a sub-wave of the up 5 wave that started at $1779.

2022年3月27日星期日

Saudi oil facilities were attacked, Brent oil rose more than 11% this week and stood at the 120 mark

Huitong Network News – On March 26, Brent oil futures rose 1.4% to settle at $120.65 per barrel; this week’s cumulative increase was 11.5%, the first weekly rise in nearly three weeks. Oil prices rose after an attack on the North Jeddah Bulk Plant, a storage facility of Saudi state oil producer Saudi Aramco, according to people familiar with the matter. Meanwhile, traders are also examining the impact on crude prices of a possible release of U.S. oil reserves.

On Friday (March 26), U.S. oil futures rose 1.4% to settle at $ 113.9 a barrel; the cumulative increase for the week was 8.8%. An attack on an oil storage facility in Saudi Arabia on Friday marked an escalation in tensions in the world's main oil exporter and added uncertainty to an already fragile crude supply. Yemen's Houthi rebels say they have attacked Saudi energy facilities, and the Saudi-led coalition said the Saudi Aramco fuel distribution station in Jeddah was attacked, but a fire at two oil storage facilities at the facility has been reported

.

control. "Such aggressive actions target oil facilities and are designed to try to influence energy security and the global economy," Saudi Defense Ministry spokesman Turki al-Maliki told the Saudi Press Agency after the attack. Saudi Arabia warned this week that crude supplies were at risk and called on the United States to do more to help deal with Houthi attacks.

Rohan Reddy, research analyst at Global X Management, said the attack on Saudi Aramco's facilities could cause some short-term disruptions to operations and could temporarily reduce Saudi oil supplies. Continued broader geopolitical issues in the country could lead to longer production cuts and put upward pressure on oil prices. The company manages $2 billion in energy-related assets. Andrew Lipow, president of Lipow Oil Associates, said: “In a market that has already reduced Russian oil supplies, there is another thing to worry about, Houthi attacks could impact Saudi production. Houthi attacks are becoming more frequent. A

U.S. source said the Biden administration is considering another release of oil from the Strategic Petroleum Reserve that, if implemented, could exceed the 30 million barrels released earlier this month.

Oil prices rose this week as Russia's war with Ukraine continues to roil an already tense commodityMarkets; the U.S. and U.K. have moved to ban imports of Russian oil, and many energy companies have shunned Russian crude; however, Indian buyers appear to be buying some Russian crude.

EU industrial powerhouse Germany has said it plans to quickly stop buying Russian fossil fuels, but has warned that an immediate embargo is out of the question as it would damage the economy. Austria also said it would not agree to an embargo on Russian oil and gas , saying the ban was "unrealistic" for the country.

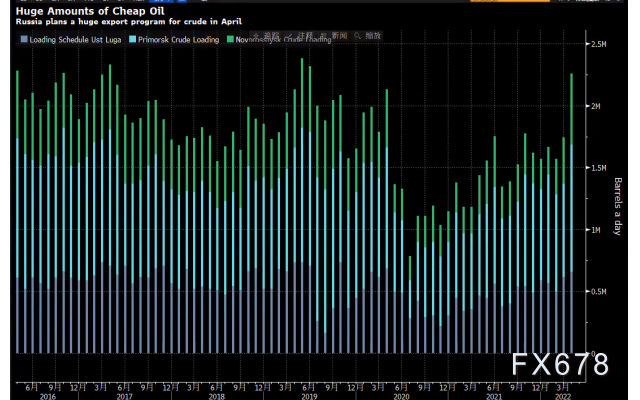

Russia's state-owned oil pipeline company Transneft has unveiled plans to load tankers with 2.26 million barrels a day of crude from three western ports in April. This would be the highest level since June 2019 and also a significant increase from this month. Transneft's sprawling April shipments have surprised traders, as many had expected Russia's exports to remain stable or even fall further from March levels. Typically, more than 70 percent of Ural crude oil exported by sea goes to Europe. However, most refiners in Europe have reduced their purchases since the Russo-Ukrainian war.

Indian refiners have purchased at least 8 million barrels of Urals crude, most of which were shipped in April, according to compiled data. However, Asian demand alone does not appear to be enough to digest Russia's export plans for April. That means Russia will face pressure to lower its loadings unless enough tanks or ships can be found to store crude, traders said. The question of who will buy Russian oil has become critical since Russia invaded Ukraine in late February. Global crude supplies will suffer if no other region takes over the Russian oil that Europe has refused to buy. If buyers do emerge, it would mean a rerouting of oil trade and less impact on global crude supplies.

U.S. oil rigs added seven rigs for the week to 531 in the week to March 25, the most since April 2020, according to Baker Hughes data, as the U.S. government urged oil producers to boost output after Russia invaded Ukraine. The active rig count is an early indicator of future production. Although the number of active rigs has increased for 19 consecutive months, the increase has been small and has slowed recently.

-

NFT project Doodles announced Friday that it has hired former Billboard executive Julian Holguin as CEO. Holguin joined Billboard in 2012...

-

Golden Finance reported that Debevoise & Plimpton lawyer Elliott Greenfield revealed that Kyle Roche may not be the only lawyer in the...