There's no sign that oil prices will pull back anytime soon, but that doesn't mean there's going to be a new wave of production. U.S. oil producers are struggling with rising costs caused by inflation, labor shortages and investor sentiment, all of which have affected their ability to ramp up output.

The U.S. energy sector gained 6.6% last week, thanks to a rise in crude prices following a series of attacks by Yemen's Houthi rebels on Saudi Aramco's oil storage facilities.

May Brent crude oil (CO1:COM) closed at $ 120.65 a barrel, a weekly gain of 12%, while May WTI crude oil (CL1:COM) closed at $113.90 a barrel, a weekly gain of 10.5%.

The attacks come at a time when supply risk is higher than it has been in years, and Phil Flynn of Price Futures Group said the gap between supply and demand will only get worse.

Meanwhile, U.S. Natural Gas (NG1:COM) surged 15% over the week to $5.571/MMBtu on news that the U.S. will increase LNG shipments to Europe to reduce Europe's reliance on Russian gas driven by optimism.

The oil and gas market is markedly optimistic, and with the global energy crisis and high fuel prices, uncharacteristically encouraged by a Biden administration, you would think that U.S. producers would open the oil and gas valve and scramble to make money. Still, more work appears to be needed to get chronically struggling U.S. producers to ramp up output. This situation is mainly due to the following three reasons:

A recent survey by the Federal Reserve Bank of Dallas found that major oil companies intend to grow crude output by an average of just 6% a year, while smaller oil companies plan to grow 15%. Nearly a third (29%) of respondents said economic growth would not depend on oil prices. More than half of respondents attributed the slowdown to investor pressure to maintain capital discipline , suggesting they have learned some hard lessons over the past few years.

Another major reason why big oil companies are only looking to ramp up production modestly is inflation and the consequent rise in costs .

According to the report, several indicators of oil and gas business activity in the first quarter have reached record highs. Service prices, oilfield service companies' operating profits and industry labor metrics all hit six-year highs in a Dallas Fed survey.

Unfortunately, input costs for oilfield service companies, as well as E&P companies for discovering, developing resources and operating leases are at record highs. Costs for oilfield services companies and E&P companies rose for the fifth consecutive quarter, as did lease operating expenses, discovery and development costs for E&P companies. The input cost index for oilfield services companies hit a record high.

Ryan Lance of ConocoPhillips said earlier this month: “We are facing the same inflation and supply chain issues as other manufacturers in the U.S. A range of commodities and categories from land, trucking and chemicals imported from Europe All of these supply chain issues are impacting our ability to do so.” Drilling new oil now will not immediately ease the rise in oil prices, which will continue globally for at least a year, he said.

Vicki Hollub, CEO of Occidental Petroleum, also said: "We have never faced a situation where we need to increase production, not only in our industry, but the actual supply chain of every industry in the world is affected by the epidemic, and the situation in this industry is very serious. "

There are rigs, but no employees . However, oil companies must understand that oilfield services, especially onshore drilling contractors, must pay a livable fee to justify the large capital costs required to operate, upgrade and equip modern onshore rigs. Lack of staff, delivery, and the cost of piping, frac sand, cement, etc., are all business concerns. It will take quite a while to achieve growth. And investor pressure.

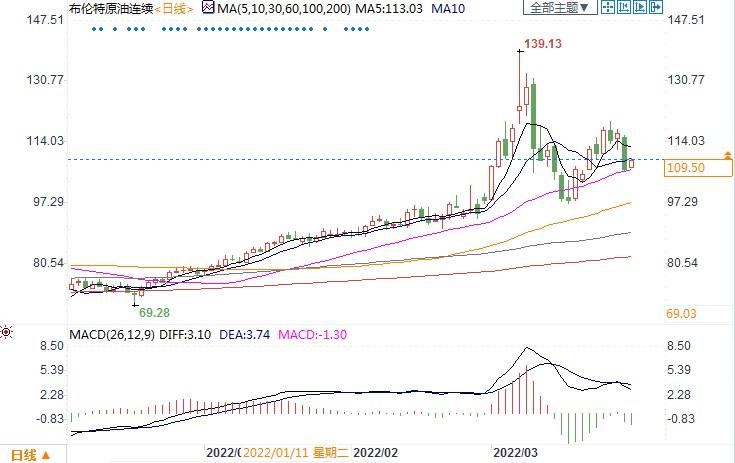

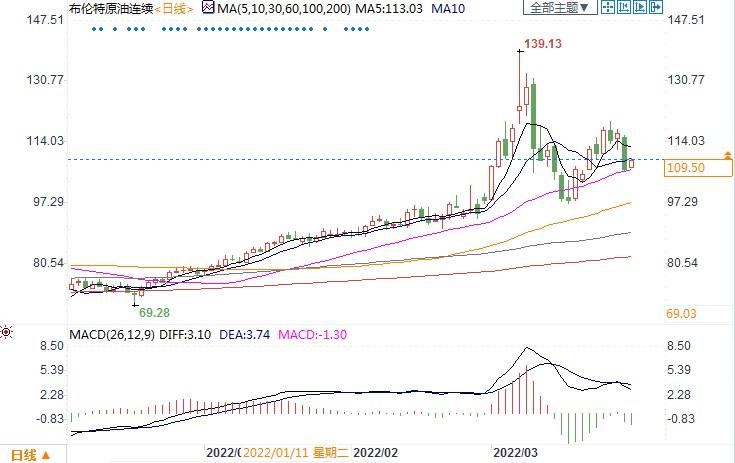

Brent crude oil daily chart

at 15:30 on March 29, Beijing time, Brent crude oil continuously reported $109.50 per barrel

May Brent crude oil (CO1:COM) closed at $ 120.65 a barrel, a weekly gain of 12%, while May WTI crude oil (CL1:COM) closed at $113.90 a barrel, a weekly gain of 10.5%.

The attacks come at a time when supply risk is higher than it has been in years, and Phil Flynn of Price Futures Group said the gap between supply and demand will only get worse.

Meanwhile, U.S. Natural Gas (NG1:COM) surged 15% over the week to $5.571/MMBtu on news that the U.S. will increase LNG shipments to Europe to reduce Europe's reliance on Russian gas driven by optimism.

The oil and gas market is markedly optimistic, and with the global energy crisis and high fuel prices, uncharacteristically encouraged by a Biden administration, you would think that U.S. producers would open the oil and gas valve and scramble to make money. Still, more work appears to be needed to get chronically struggling U.S. producers to ramp up output. This situation is mainly due to the following three reasons:

hard lesson

A recent survey by the Federal Reserve Bank of Dallas found that major oil companies intend to grow crude output by an average of just 6% a year, while smaller oil companies plan to grow 15%. Nearly a third (29%) of respondents said economic growth would not depend on oil prices. More than half of respondents attributed the slowdown to investor pressure to maintain capital discipline , suggesting they have learned some hard lessons over the past few years.

cost rise

Another major reason why big oil companies are only looking to ramp up production modestly is inflation and the consequent rise in costs .

According to the report, several indicators of oil and gas business activity in the first quarter have reached record highs. Service prices, oilfield service companies' operating profits and industry labor metrics all hit six-year highs in a Dallas Fed survey.

Unfortunately, input costs for oilfield service companies, as well as E&P companies for discovering, developing resources and operating leases are at record highs. Costs for oilfield services companies and E&P companies rose for the fifth consecutive quarter, as did lease operating expenses, discovery and development costs for E&P companies. The input cost index for oilfield services companies hit a record high.

Ryan Lance of ConocoPhillips said earlier this month: “We are facing the same inflation and supply chain issues as other manufacturers in the U.S. A range of commodities and categories from land, trucking and chemicals imported from Europe All of these supply chain issues are impacting our ability to do so.” Drilling new oil now will not immediately ease the rise in oil prices, which will continue globally for at least a year, he said.

Vicki Hollub, CEO of Occidental Petroleum, also said: "We have never faced a situation where we need to increase production, not only in our industry, but the actual supply chain of every industry in the world is affected by the epidemic, and the situation in this industry is very serious. "

labor shortage

There are rigs, but no employees . However, oil companies must understand that oilfield services, especially onshore drilling contractors, must pay a livable fee to justify the large capital costs required to operate, upgrade and equip modern onshore rigs. Lack of staff, delivery, and the cost of piping, frac sand, cement, etc., are all business concerns. It will take quite a while to achieve growth. And investor pressure.

Brent crude oil daily chart

at 15:30 on March 29, Beijing time, Brent crude oil continuously reported $109.50 per barrel

沒有留言:

發佈留言