2023年7月14日星期五

Forex EA

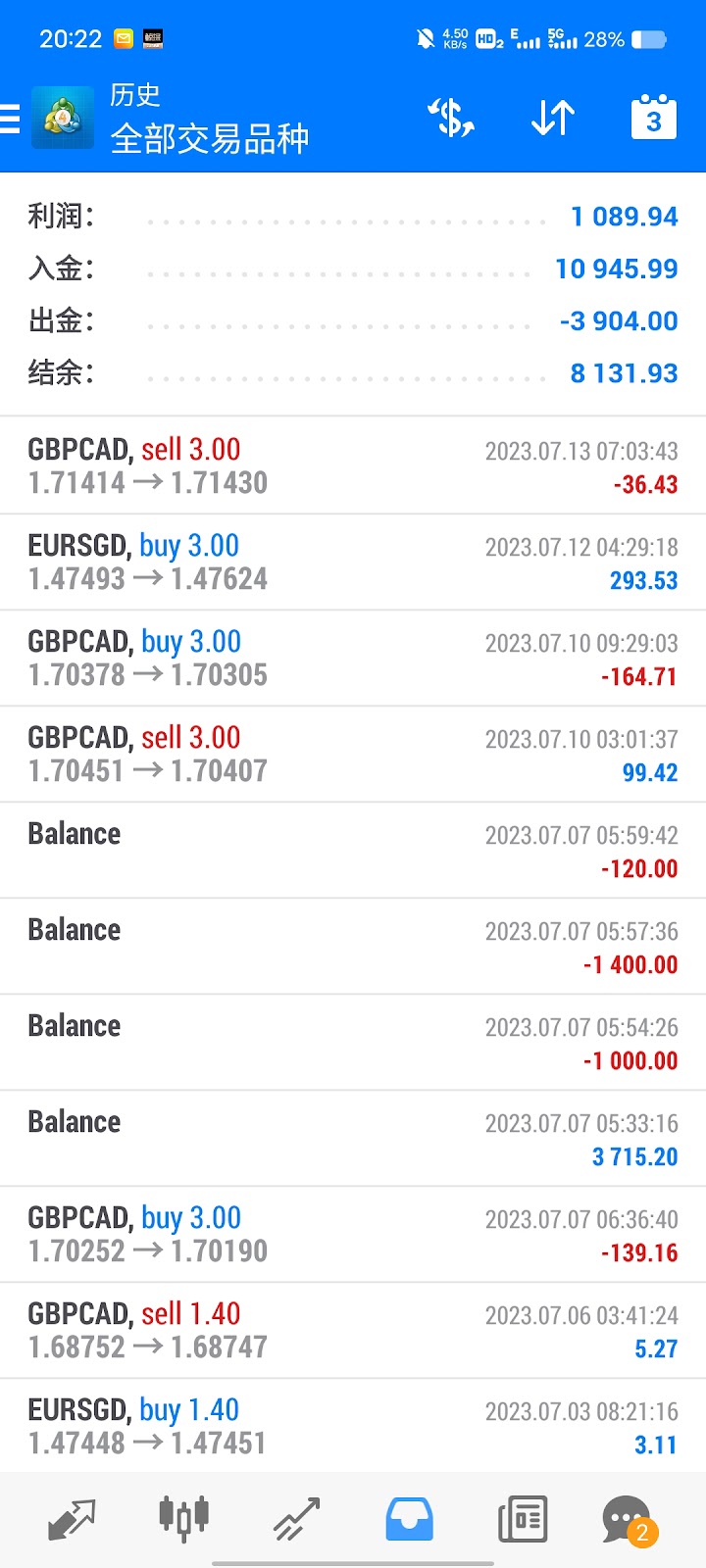

这两天单边行情,依然对我们的EA没有影响!还是稳如泰山向盈利慢慢推进!需要代挂的pm

The unilateral market in the past two days still has no effect on our EA! It is still as stable as Mount Tai and slowly advancing towards profitability! The pm that needs to be linked

#外汇代挂 #稳定EA #EA代挂 #外汇交易 #forex #资管 #稳定收益 #非农行情 #外汇市场 #交易知识 #外匯交易 #外匯代掛 #EA智能交易系統 #EA交易 #專業EA #資管機構 #外匯量化交易

2022年9月4日星期日

The Argentine Tax Agency can directly debit users' digital accounts in the future to pay off debts

The Argentine Tax Agency (AFIP) recently won a landmark case that allows it to seize funds from the digital accounts of users in the country to pay tax-related debts. The request was rejected by a judge in the first instance, but was eventually upheld by the Mar del Plata Federal Court, which held that technologies such as digital accounts could not be a vehicle for taxpayers to evade taxes. In the future, the tax bureau can confiscate all the funds owed by the user to the state, and add 15% interest and handling fees. However, lawyer Eugenio Bruno believes that due to the peculiarity of encrypted assets, unless the authorities seize user assets directly through the exchange, users may not voluntarily surrender their private keys, which may make the final seizure difficult to execute. (news.bitcoin)

Roche Freedman lawyers other than Kyle Roche are rumored to hold large amounts of AVAX

Golden Finance reported that Debevoise & Plimpton lawyer Elliott Greenfield revealed that Kyle Roche may not be the only lawyer in the CryptoLeaks video to obtain shares in Ava Labs and AVAX tokens. Roche Freedman Law Firm, in addition to Kyle Roche, includes Devin "Vevel" Freedman Attorneys such as Amos Friedland and Edward Normand, who may hold large amounts of AVAX tokens, did not respond to requests for comment by press time. According to previous reports, Cryptoleaks broke the news in a video on its official website that Avalanche development company Ava Labs reached a cooperation agreement with Roche Freedman, a U.S. law firm a few years ago. The content is that Ava Labs paid Roche Freedman a large amount of Ava Labs equity and AVAX (current value). hundreds of millions of dollars), and Roche Freedman has launched malicious lawsuits against rivals such as Binance, Solana Labs, and the Dfinity Foundation. (Blockworks)

Smart Cube: maintain cooperative relations with downstream mainstream VR/AR manufacturers

According to news on September 4, Zhicube recently stated in an institutional survey that sensing and identification detection equipment, as the basis for the development and business of Zhicube, has first-mover advantages in technology and products. New consumer electronics application platforms, such as AR/VR, are currently the most widely used and comprehensive devices for various types of sensors in consumer electronics products, and they are also products that reflect the core technology in the field of sensor testing.

2022年7月28日星期四

Golden Sentinel | The interest rate hike landed, Powell made a speech to boost the market, and BTC rose for a short time

The Fed wrapped up a two-day meeting with Fed Chairman Jerome Powell announcing another 0.75 percentage point rate hike as policymakers try to cool decades of high inflation. Major stock indexes surged, with the Nasdaq 100 on track for its best one-day gain since November 2020, as Federal Reserve Chairman Jerome Powell spoke at a news conference and suggested the central bank may slow the pace of interest rate hikes. At the same time, the crypto market rallied for a short time, with Bitcoin breaking above $23,000 at one point.

Previously, the market had expected a rate hike, and Powell’s remarks to boost the market and the landing of rate hike boots brought respite to the stock market and the crypto market. A BlackRock strategist said Powell had signaled the Fed was aware of the negative economic impact of its rate hikes, which boosted stocks Wednesday afternoon.

Powell said the Fed is likely to slow the pace of rate hikes in the coming months. No specific guidance will be provided for the September meeting. Another big rate hike is likely, but it will be data-driven and no decision has been made on when to slow rate hikes. At the same time, he doesn't think the U.S. is currently in a recession because so many sectors of the economy are doing too well. But growth is slowing for reasons we understand.

However, in the face of Powell's remarks that boosted the market. Many analysts believe that this is not a buying opportunity for investors. Jack Ablin, chief investment officer at Cresset Capital, said that while all eyes will be on the Fed today, the real show will begin on Aug. 10 when U.S. inflation data is released. We and the market are betting on a weaker number.

Rick Rieder, a managing director at BlackRock and chief investment officer (CIO) of BlackRock Global Fixed Income, told CNBC that he expects the Fed to raise rates by 0.75 percentage point on Wednesday, and there may be two more rate hikes. "I think that means you're going to see 50 basis points in September, they're probably going to do another 25 basis points, I think that's it," he said. "The data says it all, it's about what the Fed does, not what they do." what did they say".

In addition, Ed Moya, senior market analyst at Oanda, said that the time may not be ripe for investors who are eager to buy risk assets and are ready to buy risk assets. There won't be a clear green light to buy risky assets until we see evidence that inflation is falling. Inflation risks will continue to rise due to possible energy shortages, supply chain issues will not ease given the weak global outlook, and issues related to the pandemic remain troubling.

Notably, despite the short-term gains in the crypto market, Tobias Adrian, head of monetary and capital markets at the International Monetary Fund (IMF), warned in a recent interview that the crypto industry could get worse.

Adrian believes that more cryptocurrency projects may fail in the future. It is worth noting that the current cryptocurrency crisis was largely triggered by the downfall of the Terra USD (UST) algorithmic stablecoin, causing the entire ecosystem to collapse. More vulnerable fiat-backed stablecoins could see bank runs in the near future. He specifically cited stablecoin issuer Tether as an example of such a project. Still, Adrian acknowledged that some stablecoins are less vulnerable to such crises. Meanwhile, if the U.S. economy falls into a recession, there will be a sharper sell-off in digital assets.

Nearly half of buyers want to keep NFT versions of famous British artist Damien Hirst paintings and destroy physical works

On July 29th, well-known British artist Damien Hirst will burn thousands of his paintings as part of his one-year NFT project "The Currency". From September, visitors to Hirst's London private museum will be able to see some of his 10,000 paintings, which he created in 2016 and linked to NFT last year. The floor price for these NFTs is $2,000, and buyers can choose to keep the NFT or exchange it for physical paintings. For those who choose to keep the NFT version, the original painting will be burned. The deadline for decisions is July 27. The data showed that 4,851 people wanted their paintings to be burned in exchange for a digital version of the NFT, while 5,149 collectors chose to exchange their NFT for a physical version. The artworks will be burned every day during the event, which begins on September 9, and will eventually close during the Frieze Week London event in mid-October, when all remaining paintings will be destroyed. Damien Hirst has been declared the UK's richest artist in 2020, with a net worth of over $380 million. (Cointelegraph)

-

NFT project Doodles announced Friday that it has hired former Billboard executive Julian Holguin as CEO. Holguin joined Billboard in 2012...

-

Golden Finance reported that Debevoise & Plimpton lawyer Elliott Greenfield revealed that Kyle Roche may not be the only lawyer in the...