At a recent event, Cardano founder Charles Hoskinson explained why U.S. regulators are struggling to deal with cryptocurrencies, Golden Finance reports. He pointed out that the U.S. regulatory system is not equipped to deal with the revolutionary nature of cryptocurrencies. He added that the myriad of institutions that regulate U.S. financial markets are also “not ready” for crypto assets. Part of the difficulty for these institutions is that cryptocurrencies have the unique ability to change the way wealth is used, and thus the way it is classified. “In the U.S., we regulate by categories, calling something a security, another a commodity, another a currency,” Hoskinson said. “And then build regulators around those categories to specialize in those areas.” Coin as an example, explaining that it can be considered a currency, such as its legal tender status in El Salvador, or a commodity, such as gold. This makes it difficult for authorities to classify assets and thus regulate them.

2022年4月30日星期六

The Ethereum network has currently destroyed more than 2.18 million ETHs

According to data from Ultrasound, a total of 2,181,427.53 ETHs have been destroyed on the Ethereum network so far. Among them, OpenSea destroyed 230,047.27 ETH, ETHtransfers destroyed 205,677.70 ETH, and UniswapV2 destroyed 131,327.89 ETH. Note: Since the introduction of EIP-1559 in the Ethereum London upgrade, the Ethereum network will dynamically adjust the BaseFee of each transaction according to the transaction demand and block size, and this part of the fee will be directly burned and destroyed.

2022年4月28日星期四

Coinbase NFT market beta has seen less than 900 total transactions since launch

Golden Finance reported that, according to data from the crypto analysis website Dune, since the beta version of the Coinbase NFT market was launched on April 20, the total transaction volume of the market has been less than 900 (the data is collected by 0x Project, which develops the backend for the Coinbase NFT market), and the total transaction volume is less than 900. The transaction value was 73 ETH (~$217,000), and about 655 users have traded on the platform to date. The low figures could be attributed to Coinbase granting access to the platform to only a fraction of its 3 million waitlist. Coinbase told CoinDesk that because the product is in beta, it cannot confirm any user data on its NFT marketplace, which is still in its early stages of development and plans to announce exclusive partnerships in the coming months to attract more users use the platform.

PuddingSwap pudding food empire raw material synthesis task has been officially launched on April 28

According to official news, the experience version of the raw material synthesis function of PuddingSwap pudding food empire has been officially launched at 15:00 on April 28th. Users can experience the pudding synthesis function without any threshold without pledge, and the production time of the trial version of the pudding is about 12 minutes. According to the official introduction, users can synthesize chocolate pudding and Easter egg pudding by participating in the "pudding synthesis experience version". You can also participate in the joint activities of PuddingSwap and the cross-chain bridge ESBridge. PuddingSwap Pudding Food Empire is an NFT card game with the theme of baking pudding. It provides players with eight animal chef character cards. By using raw materials to bake pudding, it will be added to the income of the lock-up pool. In the future, kitchen utensils, kitchen Art battle mode, food NFT plaza and other sections.

2022年4月27日星期三

Cardano wallet addresses exceed 3.6 million

According to data from the Messari on-chain and market data aggregator, Cardano’s holdings recently surpassed 3.6 million wallets as the price of the underlying token hit a bottom of $0.8 in March. Currently, addresses holding around 100 ADA are the largest representatives of the network, while only 3,042 holders have a balance of more than 1 million ADA. (u.today)

Neihuang Public Security successfully busted a criminal gang that used "virtual currency USDT" for fraud

A few days ago, the Dongzhuang Police Station of Neihuang County Public Security Bureau successfully cracked a fraud case of using digital currency USDT for money laundering, destroyed a criminal den, arrested 15 criminal suspects, and seized 6 computers and 18 mobile phones according to law. , more than 40 bank cards. In March 2022, the police at the Dongzhuang Police Station of the Neihuang County Public Security Bureau obtained a clue of telecommunication fraud, and found that this was a criminal case of using the digital currency USDT for money laundering and fraud. On the evening of April 8, at a hotel in Anyang City The criminal suspect Liu was successfully captured, and at the same time, the other four associates of Liu were also arrested. According to Liu's confession, since February 2022, Liu has drawn others to collude with telecommunications network fraud gangs through "cold wallets", buying low and selling high, frequently trading virtual currency USDT on a large scale, helping fraud gangs launder money and making profits from it , after the police review according to law, the funds involved in the case are as high as 10 million. Up to now, all the persons involved have been taken compulsory measures by the Neihuang County Public Security Bureau in accordance with the law, and the case is being further processed. (Tencent.com)

BitMEX founder: FX surplus in global surplus countries will push Bitcoin price to $1 million

On April 27th, BitMEX founder Arthur Hayes released a new blog post to discuss his market views. Arthur Hayes believes that the current world monetary policy is inevitably going to collapse, and the foreign exchange sanctions imposed by the United States and Europe against Russia in the conflict will change the world. Trade surplus countries will lose trust in the dollar and the euro, which may lead to the purchase of censorship-resistant bitcoins by surplus countries led by China, and will increase the government deficits of the United States and the European Union on the one hand. Arthur Hayes predicts that the deficit will allow the Fed to create negative real interest rates by fixing Treasury rates, and the euro will eventually collapse due to the deficit, all accelerating Bitcoin’s journey to $1 million. Bitcoin must have a new circulation scene, and the coin culture will bring a huge crisis to the network after the disappearance of mining rewards.

2022年4月26日星期二

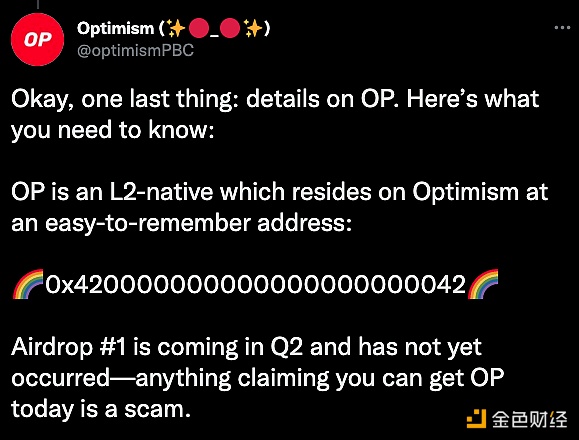

Optimism will issue token OP and announce token economics, 19% of initial supply will be used for airdrop

The Ethereum expansion plan, officially announced that it will issue the token OP and announce the token economics. The initial total supply of tokens is 4,294,967,296 OP tokens, and the total supply will expand at a rate of 2% per year. 19% of the initial OP token supply is reserved for user airdrops, of which 5% will be allocated in Airdrop #1, a total of 264,000 addresses are eligible for airdrops, the average number of airdrops per address is 2,311, and the snapshot time is March 25 Today, another 14% will be distributed in future airdrops. At present, users can view the specific airdrop quantity at this URL.

Moonbeam partners with IOSG Kickstarter Program to empower early-stage projects

On April 26, Moonbeam, a Polkadot-based EVM-compatible smart contract development platform, joined hands with the IOSG Kickstarter Program to empower early projects. PureStake CEO Derek Yoo, who supports the operation and development of Moonbeam, has become an IOSG Kickstarter Program mentor, working with IOSG to provide comprehensive support for start-up projects in the encryption field. Currently, both Moonbeam Foundation and Kickstarter Program have opened grant application channels for start-up teams. Any developers and early-stage projects with ideas can apply for funding, resources, technical guidance and other support.

The Chinese Simulation Society established the Metaverse Professional Committee, with representatives from Tencent and NetEase participating

That recently, the Metaverse Professional Committee of the Chinese Simulation Society was established in Beijing. This is the first Metaverse Professional Committee established by a first-level society affiliated to the China Association for Science and Technology. According to reports, the association also includes representatives from Peking University, Renmin University of China, Beihang University, Zhejiang University, Hangzhou Dianzi University, Beijing University of Posts and Telecommunications, Beijing Film Academy, Beijing Normal University, Communication University of China, National Academy of Painting, Tencent, NetEase 116 representatives of relevant units such as Beijing Institute of Technology, Blue Cursor, etc. were elected members of the special committee, which is affiliated with the School of Computer Science, Beijing Institute of Technology. The special committee will carry out the new mechanism of the Metaverse, build a platform for academic exchanges and exhibitions at home and abroad, and promote the development and application of the Metaverse technology industry; actively participate in the science and technology policy and planning in the field of Metaverse technology, and undertake the science and technology in related disciplines. Project demonstration, standard formulation, technical title or professional qualification evaluation, etc. (iResearch)

2022年4月25日星期一

Astar Network's first network, Shiden, starts the second round of Crowloan

On April 25th, Astar Network recently announced that Shiden Network, the pioneer network, will participate in its second crowd loan auction to continue to hold its Kusama parachain slot. The Shiden Network will participate in the upcoming Kusama crowdfunding. The Astar team finally decided to proceed with crowdfunding for auctions. The funds obtained from all crowdfunding activities will be used to rent its parachain slot on Kusama. Once the lease expires, all the tokens of the crowdfunding will be refunded to Participant account. The crowdsale auction starts from April 22nd to April 28th, with the goal of collecting 15,000 Kusama Tokens (KSM), with a fixed budget of 350,000 SDN for the Shiden Token reward. It is reported that Shiden Network successfully took a slot in the first crowd-lending event in June 2021 and became a parachain on Kusama Network, and the slot lease period will end on May 16, 2022. Astar Network is the #1 smart contract hub for WASM + EVM on Polkadot.

Solana Metaverse Solice will start the public sale of land at 21:00 on April 26

It was reported on April 25th that Solana’s ecological metaverse project Solice will start the public sale of land at 21:00 on April 26th, Beijing time. This sale will be held on the Solice Marketplace. A total of 1,200 plots will participate in the sale, which is only available for users. Solice’s native Token SLC is paid for, and plots of 6x6 (starting price 4000SLC) and 9x9 (starting price 8000SLC) will be sold by auction. The auction start time has not been announced yet. As previously reported, Solana-based metaverse project Solice announced on December 2, 2021 the completion of a $4.3 million financing round led by Three Arrows Capital, Animoca Brands and DeFiance Capital, Alameda Research, Jump Capital, Genblock Capital, Kucoin Labs and others participated in the investment.

2022年4月24日星期日

Project Name: Meow New Ball

Project Name: Meow New Ball

Society Name: NFT Card Series Coins

Operation mode: new mining mode, no need to reinvest, just click to sign in 12 hours a day to start mining

Whether investment is required: 0 ceiling-level projects

Payback cycle: zero investment

How to join: real-name authentication after registration, sign in and start the miner after authentication, once every 12 hours

ITHEUM token will be listed on Elrond Maiar DEX on April 25

On April 24th, Itheum, a decentralized multi-chain data brokerage platform, announced that the ITHEUM token will be listed on Elrond Maiar DEX on April 25th. Launched in October 2021 by Morningstar Ventures, Itheum is a pioneer project of the Elrond Dubai incubator. Itheum aims to transform personal data into tradable assets, empowering users by helping them regain control over their data in the age of Web3 and the Metaverse.

Chinese Online's revenue in 2021 will exceed 1 billion yuan, and continue to explore applications and development in the Metaverse

On the evening of April 24, Chinese Online released the 2021 annual report. In 2021, the operating income will be 1.189 billion yuan, an increase of 21.82% over the same period of the previous year; the net profit attributable to the parent is 98.7915 million yuan, an increase of 101.93% over the same period of the previous year. During the reporting period, the company has determined the development strategy of "consolidating content, serving the industry, and winning IP", a development strategy driven by domestic and international two-wheel drive, and formed a core of digital content production and authorization, IP cultivation and derivative development, intellectual property protection and metaverse. Explore a business system with two wings, and comprehensively deploy the digital cultural content industry. Chinese Online said that in the face of opportunities, the company will plan ahead, go all out, and take the initiative, focusing on the application and development of digital content IP in the Metaverse, actively exploring innovation, and embracing the digital economy. (China Securities Journal)

The address marked as singer Huang Licheng has 102 MAYC, which is the second largest holder of the NFT series

According to the news on April 24, according to the OKLink blockchain browser, the address marked as singer Huang Licheng (MachiBigBrother) is 0x020cA66C30beC2c4Fe3861a94E4DB4A498A35872. Up to now, there are 102 mutant ape MAYC (the second largest holder), 55 boring Ape BAYC (the sixth largest holder), 1.51 million APEs (about 24 million US dollars).

The market value of "Boring Ape" BAYC exceeded 4 billion US dollars, and the floor price reached 137 ETH

According to the latest data from Dapprader, as the floor price of “Boring Ape” BAYC hit a new high of 137 ETH, its market value also exceeded 4 billion US dollars, which has reached 4.05 billion US dollars at the time of writing this article. According to OpenSea data, the total transaction volume of BAYC has exceeded 500,000 ETH, and so far it is 505,800 ETH.

Meta employees unhappy with Zuckerberg's Metaverse obsession: don't know what to deliver

Mark Zuckerberg's obsession with the metaverse has sparked dissatisfaction among employees of Meta (formerly Facebook), who believe that "the metaverse has become the only thing Zuckerberg wants to talk about", so much so that many people are interested in him People at work are frustrated. Currently, Meta has formed a Metaverse-specific team", which employees believe is a team that "will cover all teams in the company", but many people are still very confused, on the one hand worried about inciting confusion and anxiety, on the other hand It's employees who don't seem to really know what to deliver or what to do, and Meta has so far not had a coherent metaverse strategy. (businessinsider)

2022年4月20日星期三

Layer 1 scaling: sharding and composability

Ethereum and other public chains are trying to use the multi-chain structure to expand capacity, such as the homogeneous sharding that may be realized by Ethereum 2.0, the heterogeneous sharding that Polkadot is implementing, and the cross-chain structure of COSMOS. Networks such as the Avalanche Protocol, in the multi-chain structure, define function stratification and function modularization in a more detailed manner to achieve capacity expansion.

These are huge and long-term designs. Polkadot is still going through slot auctions, COSMOS is still building infrastructure, and the technical progress and ecological construction of the rest of the chains are still in their early stages.

For other projects that focus more on expansion, they may also focus more on a single network structure, such as implementing sharding in layer1, representing the project Near. In the long run, the expansion of layer1 (such as sharding) is inevitable. After these networks are compatible with EVM, DApps such as Defi can be quickly migrated to the network. If the asset transfer problem is solved, these networks will become the extended network of Ethereum.

So what kind of layer1 does DApp need? The preceding principles are 2:

1. Solve the performance bottleneck caused by the consensus problem.

2. Do your best to be composable.

The homogeneous sharding and heterogeneous sharding we mentioned earlier, the distributed shards are a chain composed of some nodes. It can be understood that some nodes are divided into a partition, this partition exists independently of other partitions, and tasks are processed separately.

For example, in Ethereum 2.0, if you still follow the original roadmap for sharding, 64 shards may be established in the initial stage, and these shards will eventually be verified by the beacon chain. The communication between shards is called "cross-linking" , if one of the shards needs to verify the other shards, the communication between the shards will be carried out. Because of the existence of shards, DApp developers need to choose a shard as the main processing area when developing DApps on Ethereum.

This means that if this DApp needs to obtain data from other shards, there will be some complicated steps. The same is true for the structures implemented by Polkadot and COSMOS. Polkadot’s parachains are shards in a heterogeneous sharding structure. The interaction between parachains is carried out through the relay chain, but the interaction process is more complicated and requires parallel chains. to be defined separately. The same goes for COSMOS.

Such sharding is a design that delimits boundaries. Each sharding chain may form a certain island effect, so it is necessary to ensure that communication capabilities are maintained between chains, or between shards and shards, and this communication is effective. And can solve the underlying data availability. That is, when DApp needs data across slices, it does not need to consider the situation that the data is not universal and the standards on both sides are different.

Polkadot's XCM and COSMOS' IBC are all doing this.

But if you change your thinking, you may generate some new technical ideas.

For example, a new consensus mechanism can be designed in the form of database sharding. It can be understood as a new sharding structure of database sharding + consensus.

This kind of sharding is different from the above-mentioned definition of some nodes as sharding chains. Instead, all computing resources added to the network are first divided into different shards. The shards are not divided by chains and nodes, but by The random command is randomly assigned to the determined shard location, and these shards divided by the command form a large partition.

This method of pre-setting the shard locations, and then dynamically assigning commands to various locations to form shards requires consensus to confirm the final state. This approach is much like the hybrid form of shard chains in Ethereum 2.0, where the dominant consensus process needs to be the same as the beacon chain's ghost algorithm to achieve finality.

The best way to do this is to achieve greater parallelism and mobilize all resources to use instead of some boundary problems caused by fixed partitions.

Second, possibly important issue is compositionality.

Compared with Ethereum, the on-chain compositionality is the interaction between smart contracts. For example, cTokens borrowed through Compound can be mined and swapped in other DeFi. This means that the DeFi contract needs to call the Compound contract to confirm the cToken. The invocation between the contracts is a manifestation of compositionality.

If the two are not deployed in the same network or shard, it is difficult to combine them, requiring gateway processing or the existence of a mapped smart contract. Without boundary issues, these composability would not be constrained.

Of course, there is obviously a problem with the structure of the chain. That is, in the entire ecosystem, whether the chain that is more inclined to the bottom is universal.

This general problem will also affect the definition of how to divide a certain layer. It can be said that sharding is an option for one-layer expansion, but in other networks, sharding can be a two-layer structure.

In addition to technical definition and design, the overall progress may be related to several other factors.

For example, Ethereum 2.0 is homogeneous sharding, and the chain and node standards of sharding are unified. However, if it is not considered technically and decentralization is considered, the realization of sharding in Ethereum will be limited to "maintain" and "do as well as possible" decentralization. That is, building shards, building nodes, node rewards, and subsequent stability all require users to complete them spontaneously.

However, many public chains directly use partners or self-built nodes to solve these problems. Instead, come first. This makes Ethereum lose a lot of advantages and changes the structure of the entire market.

When the huge public chain structures such as Ethereum, Polkadot, and COSMOS have not yet progressed, many chains have already overtaken them, such as Near and Solana, but there are still many changes in development. Ethereum will realize the split in 2023. The development progress of Cosmos and Polkadot may also be concentrated in 2023, which can be expected.

2022年4月18日星期一

Online 2 days floor price 20ETH Moonbirds history

For two days on the weekend, the circle is paying attention to a project-Moonbirds.

On April 16, it was officially put on sale at a price of 2.5 ETH , with a total of 7875 pieces, which were sold out within a few hours. According to the price of ETH USD, the funds raised in this sale are about 66 million US dollars. It is reported that 100% of the proceeds will be donated directly. To PROOF Holdings Inc, a web3 media company backed by True Ventures;

On April 17, the 24-hour trading volume has exceeded 110 million US dollars, and the floor price has gradually risen, and as of 11:00 on April 18, it was 19.69 ETH;

On April 18th, Moonbirds #3904 was traded at a price of 150 ETH, or about $457,000, setting a record for the highest transaction volume of the NFT series.

Granted, the NFT market is highly introverted, but Moonbirds seems to have easily won the market’s attention.

Granted, the NFT market is highly introverted, but Moonbirds seems to have easily won the market’s attention.

Moonbirds is a series of bird-based NFT avatars launched by the podcast program PROOF (founded by True Ventures partner Kevin Rose, PROOF is a high-quality podcast focused on the NFT field), with a total of 10,000 pieces. Of these 10,000, 2,000 were offered to PROOF Collective NFT holders through free minting, 125 were distributed by the Moonbirds team, and the remaining 7,875 were minted by those who were licensed through a public lottery at 2.5 ETH each.

Moonbirds are created on the Ethereum network , and each bird has different characteristics that indicate their rarity. It was originally launched as a Dutch auction starting at 2.5 ETH, but due to high demand, the team opted for a raffle and a whitelist sale (the whitelist is often used to prevent bot attacks from falling in demand). With thousands of NFTs, why is Moonbirds so popular?

Moonbirds is said to be promising more than many other NFT projects, which explains why the demand for Mint is so strong despite its high price. Moonbirds ostensibly resemble cute bird characters, but in reality they are PROOF's "utility NFTs" .

PROOF was a huge success when it launched PROOF Collective, a private membership club of just 1,000 NFT collectors and artists. PROOF Collective's first product, called Grails, showcases ultra-rare pieces from the likes of Larva Labs and Tyler Hobbs, as well as its floor price of 100 ETH on the secondary market. NFT holders with this permission have special permissions to access PROOF private Discord, listen to the latest podcasts in advance, participate in offline activities, and so on. In previous episodes, PROOF has also invited Beeple, GaryVee, John Crain ( SuperRare CEO), Gabby Dizon (YGG co-founder), Alexis Ohanian (Reddit co-founder), Tyler Hobbs (Fidenza creator), etc. Many of the most well-known artists, practitioners and other big names in the NFT field discussed the most cutting-edge topics in the NFT field, and their content has considerable influence in the industry.

According to its CEO Kevin Rose's narrative and official content, holders of Moonbirds will roughly have the following three permissions: First, holders of Moonbirds can unlock membership in some private clubs, including entering PROOF's private Discord to participate in closed doors Discussion and so on. Second, Moonbirds holders will get advance access to PROOF's upcoming metaverse project, Project Highrise. Third, Moonbirds themselves will also have some special gameplay, and holders can put their Moonbirds into a "Nesting" state.

Officials say Nesting will launch a few days after the auction is complete. Officials will calculate the length of the current nesting cycle and the cumulative nesting time. Both will have different rewards, and PROOF officials have not announced the specific rules for nesting rewards. After entering the locked state of nesting, Moonbirds will not be able to normally trade through secondary markets such as OpenSea (it will be prompted when the buyer places an order), but it can still be transferred to other addresses in the website provided by PROOF in the form of a personal signature. The purpose of this setting is to prevent some common remote function call phishing methods.

Officials say Nesting will launch a few days after the auction is complete. Officials will calculate the length of the current nesting cycle and the cumulative nesting time. Both will have different rewards, and PROOF officials have not announced the specific rules for nesting rewards. After entering the locked state of nesting, Moonbirds will not be able to normally trade through secondary markets such as OpenSea (it will be prompted when the buyer places an order), but it can still be transferred to other addresses in the website provided by PROOF in the form of a personal signature. The purpose of this setting is to prevent some common remote function call phishing methods.

Plus, PROOF will receive 5% of all secondary sales. The proceeds will be used to continue to hire more full-time employees, fund operations and create more value for the community.

2022年4月16日星期六

360 Launches Metaverse Social Product N World

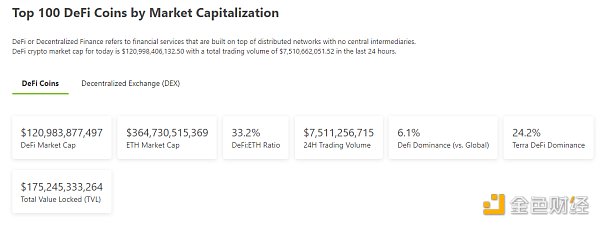

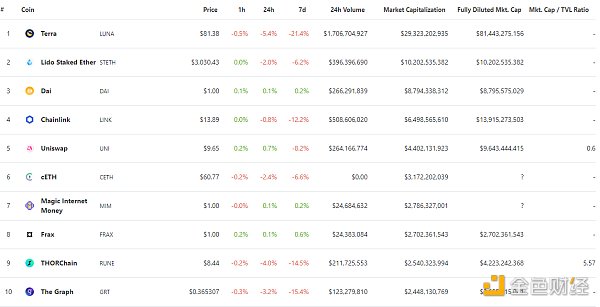

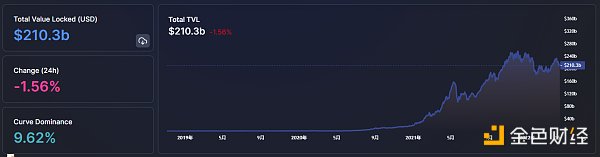

DeFi data

1. Total market value of DeFi tokens: $120.983 billion

DeFi total market capitalization data source: coingecko

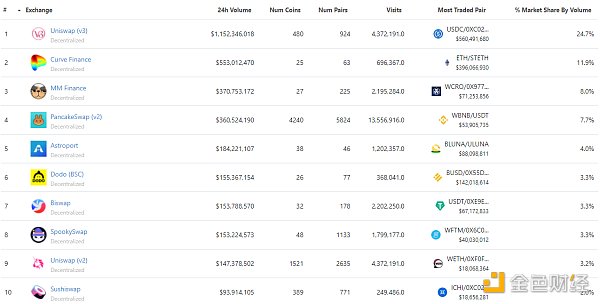

2. Transaction volume on decentralized exchanges in the past 24 hours: $4.662 billion

Decentralized exchange volume data for the past 24 hours Source: coingecko

3. Assets locked in DeFi: $210.3 billion

Top 10 DeFi Projects Locked Assets and Locked Volume Data Source: defillama

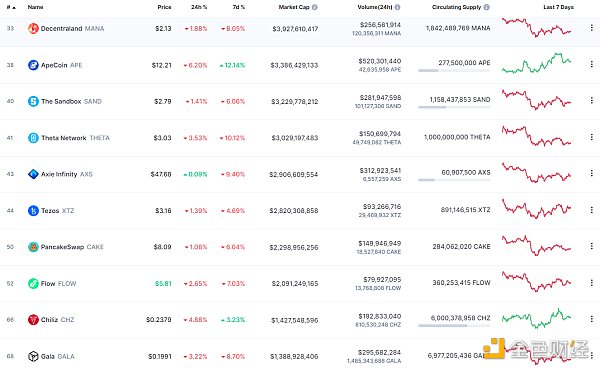

NFT data

1. Total market capitalization of NFTs: $41.596 billion

The total market value of NFT and the top ten projects by market value Data source: coinmarketcap

2. 24-hour NFT trading volume: $4.709 billion

The total market value of NFT and the top ten projects by market value Data source: Coinmarketcap

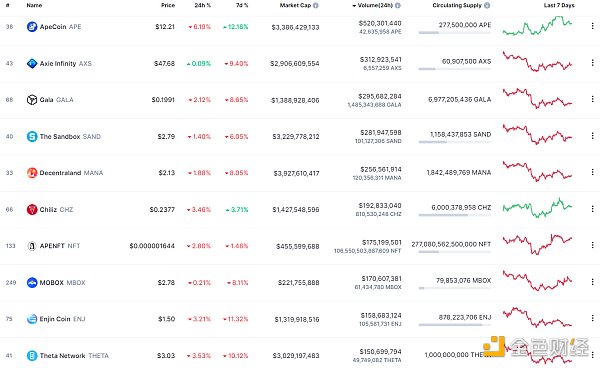

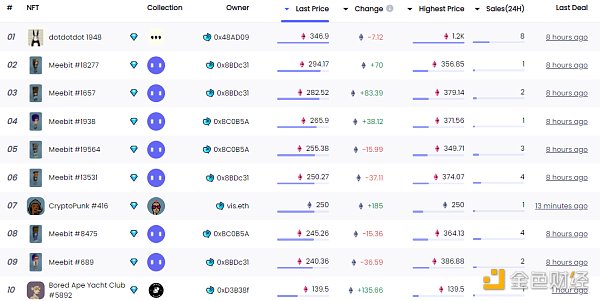

3. Top NFTs within 24 hours

Top 10 NFTs with sales increase within 24 hours Source: NFTGO

NFT hotspots

1. Ali Assets launched a limited collection of 195 cultural relics on the blockchain

Golden Finance reported that the limited collection of blockchain copyrights for digital art re-creation based on 195 precious cultural relics has been launched on Ali Assets. Part of the proceeds will be used to support the development of cultural and public welfare undertakings. The digital collection of these super national treasures is officially authorized by the China Cultural Relics Exchange Center. The digital re-creation of cultural relics is carried out in the form of 3D modeling. After repeated polishing, 12 versions have been designed successively. Finally, one version is selected and chained on the blockchain platform. , deposit and confirm rights, and generate digital artworks on the chain. It is reported that the first preview is the Houmuwu Ding, Ligui, Dake Ding, Zhuke Ding, Chunhua Ding and other 30 digital collections based on bronze wares, which will be on sale at 13:00 on April 20. .

2. LooksRare launches batch listing function

It was reported on April 15th that LooksRare has now launched the batch listing function, and users can now batch NFT listings at the same or different prices.

3. Warner Music Group announced a partnership with POAP, which will provide POAP rewards for participating fans

On April 15th, Warner Music Group announced on its official website that it has reached a partnership with the Ethereum NFT badge application POAP. The two parties will provide POAP rewards for fans who participate in Warner Music’s related activities. By minting the memory into the blockchain, collectors receive digital proof of identity verification. Launched in 2018 and launched in 2021, POAP Inc. raised a $10 million seed round in January led by Archetype and Sapphire Sport.

4. Rikkei Finance: Will fully compensate users in exploit attacks

Golden financial news, the Metaverse DeFi protocol Rikkei Finance said that users affected by the exploit attack will be fully compensated, and the team said the vulnerability is being fixed and services have been fully restored. The total loss value is approximately $1.1 million (2671BNB). It was reported earlier that Rikkei Finance was attacked because the attacker changed the oracle machine to a malicious contract.

5. Tom Brady's NFT company Autograph signs NBA star Devin Booker

On April 15, Autograph, an NFT company founded by five-time NFL Super Bowl champion Tom Brady, announced on its social networking site that it has reached a partnership with NBA Phoenix Suns star Devin Book. As previously reported, Autograph completed a $170 million Series B financing in January this year. A16z and Kleiner Perkins, an American venture capital firm, jointly led the investment and are committed to helping celebrities in sports, popular culture, fashion and entertainment sell NFTs.

6. Everlens, which provides NFT services for Instagram, will release V2 version, integrating social platform TikTok

Golden financial news, Everlens, which provides NFT services for Instagram, announced that it will release the V2 version of the NFT trading market. After the upgrade, the market will include both Everlens Social NFT and Everlens NFT, of which Everlens Social NFT will focus on third-party social network integration. In addition, the V2 version will also support credit card payments and will be integrated with social networking giant TikTok, allowing users to convert TikTok content directly into saleable NFTs.

Metaverse Hotspots

1. 360 launched the metaverse social product N World

On April 15th, recently, 360 launched a metaverse product "N World". According to reports, "N World" is a new generation of interest metaverse, which consists of "interest worlds" one by one, and everyone can create their own world. In it, users can create topics of interest, voice interactive immersive gameplay, identity cards, and private exclusive territories. According to sources close to 360, the company attached more importance to this product internally, and gave "N World" a "n.cn" domain name worth tens of millions of yuan as its official website. It is understood that this is not the first time that Zhou Hongyi has entered the metaverse. At the end of 2021, Zhou Hongyi, chairman of 360 Group, said in an interview with the media: In fact, "Huanjiao" has already made products similar to the Metaverse, but it was not particularly successful.

2. Radio Caca3D Metaverse has launched the pavilion system

According to official news, the Radio Caca3D metaverse pavilion system has been officially launched, supporting official and mainstream NFTs to enter the pavilion and conduct exhibitions. At present, 100 booths have been launched, and the NFT trading market Openpfp will be directly connected in the future. 3D Metaverse includes NFT pavilion system, building management system, decoration system, Metaverse concert, etc. It is reported that Radio Caca3D Metaverse will launch a self-built game system for players in the future. Users only need to own land to launch their own games.

3. Sanqi Mutual Entertainment Metaverse Game Art Museum will be stationed on the other side of Meta

Golden Finance reported that the game company Sanqi Interactive Entertainment (002555) will build the company's first Metaverse game art museum based on the "Internet +" action plan on the other side of the metaverse art community Meta, which is a subsidiary of Zhidu Co., Ltd., and explore metaverse social interaction. In addition, Sanqi Mutual Entertainment will also authorize some works to Zhidu Universe for the sale of related digital art collections.

DeFi hotspots

1. Lido, the staking protocol, releases a roadmap update that will build a completely permissionless and risk-free staking solution

On April 15th, the staking protocol Lido released a roadmap update on its social networking site, proposing that the next stage will be dedicated to building a completely permissionless and risk-free staking solution. The specific plans are: 1. Gradually adopt Distributed Witness Technology (DVT); 2. Create a Node Operator Score (NOS) based on different indicators, and allocate rights accordingly. In addition, Hasu, who was just announced to join Lido as a strategic advisor, also contributed to this roadmap update.

2. Rikkei Finance: Will fully compensate users in exploit attacks

Golden financial news, the Metaverse DeFi protocol Rikkei Finance said that users affected by the exploit attack will be fully compensated, and the team said the vulnerability is being fixed and services have been fully restored. The total loss value is approximately $1.1 million (2671BNB). It was reported earlier that Rikkei Finance was attacked because the attacker changed the oracle machine to a malicious contract.

DAO Hotspots

1. CultDAO approved the investment proposal for MoonDAO with 94.6% approval rate

On April 15th, CultDAO passed the investment proposal for MoonDAO with a support rate of 94.6%, and officially invested in MoonDAO's space exploration. It is reported that MoonDAO’s payment for Blue Origin’s tickets has been paid, and Blue Origin will officially announce the partnership between the two parties.

Disclaimer: As a blockchain information platform, the content of the articles published by Golden Finance is for informational reference only, not as actual investment advice. Please establish a correct investment philosophy and be sure to raise your awareness of risk.

2022年4月15日星期五

Golden Watch | Musk and Twitter turmoil

Because of the acquisition problem, Musk and Twitter are getting a lot of attention in the international market.

On April 14, Tesla CEO Elon Musk made a takeover offer to Twitter, intending to acquire it in cash at $54.20 per share, with an overall valuation of about $43.4 billion.

Musk said the reason for investing in Twitter is that it now has the potential to become a global platform for free speech, and I believe that free speech is a social responsibility for a functioning democracy.

And he believes that Twitter will neither thrive nor meet the needs of society. So, Twitter needs to transform into a private company.

Therefore, it is proposed to acquire 100% of Twitter's shares in cash at $54.20 per share.

As for whether the acquisition can be successful, on April 14, Musk said at the TED conference that if Twitter refuses, he still has a plan B. And said the acquisition is not valued for income.

Following Musk's announcement, Vanguard Group, one of the asset managers, announced that they had bought a 10.3% stake in Twitter, making it the largest shareholder.

Goldman Sachs said Musk’s offer price of $54.20 per share for Twitter was too low.

Saudi Prince Al Waleed bin Talal Al Saud, an investor who holds a 5.2% stake in Twitter, also said on social media that Musk's $54.2 purchase price proposal did not come close to the intrinsic value of Twitter, one of Twitter's largest long-term shareholders. One, he and investment firm Kingdom Holding Company (KHC) will reject the offer.

Twitter said it would review Elon Musk's offer at the advice of Goldman Sachs and Wilson Sonsini Goodrich & Rosati. Musk's plan is to buy Twitter at a cash valuation of about $43.4 billion.

Faced with some opposition, Musk launched a vote called "Taking Twitter private at $54.2 per share should be up to shareholders, not the board." Musk said it would be completely untenable if shareholders were not allowed to vote, and that shareholders, not the board, own the company.

Musk, who often influences the market and companies with his appeal, seems to be making a lot of layouts.

On March 27, some netizens asked Tesla CEO Elon Musk whether he would consider building a new social media platform, which is composed of open source algorithms, free speech is given the highest priority, and publicity is minimized. Musk responded that he was seriously considering the matter. Earlier, Musk said free speech was critical to the functioning of democracy and questioned whether Twitter strictly adhered to free speech principles.

Soon, on April 5, Twitter announced that it would appoint Musk to its board of directors.

Affected by this, Twitter (TWTR.N) rose in a straight line before the market, and is now up nearly 7%.

Musk owns 9.2% of Twitter. And the Twitter CEO also said: Musk is both a fanatical believer and a strong critic of Twitter, which is exactly what we need on Twitter.

Following the announcement, Musk said significant improvements to Twitter would be made in the coming months, adding that he looked forward to further collaboration with Parag Agrawal and the Twitter board.

A few days later, things turned around.

On April 11, Twitter CEO said: Elon Musk has decided not to join our board. Musk is our largest shareholder, and we will continue to take his advice.

Then, on April 13, Elon Musk was sued by a Twitter (NYSE: TWTR) shareholder for failing to disclose that he bought a substantial amount of the company's stock, which had an impact on the company's stock price. At this point, it was already known that Musk held a 9.2% stake in Twitter.

According to Bloomberg analysis, Musk does not join Twitter’s board of directors or wants to buy more shares. Musk currently holds about 9% of Twitter’s shares, and according to the internal restrictions of Twitter’s board of directors, his stake cannot exceed 14.9%, which means He can't get a say on the board, not only can't take over Twitter, but he can't have much influence over the Twitter service because it's very difficult to influence product decisions on the board. The Bloomberg report pointed out that Musk wants to acquire and influence Twitter, and by giving up his board seat, Musk can buy more shares of Twitter.

Musk's desire to change Twitter and his bullishness on Twitter seem to be related to the freedom that cryptocurrencies advocate. As a platform close to cryptocurrencies, Twitter has a large number of cryptocurrency users.

This brings up user expectations for Twitter and labels like free speech, decentralization, etc.

On April 7, former Twitter CEO Jack Dorsey said that he regrets Twitter. Although Dorsey has announced his resignation as CEO of Twitter, gradually fade out of Twitter. But he feels guilty about Twitter's role in promoting a "centralized internet."

Several well-known personalities have also expressed their views on Twitter's decentralization.

NBA Dallas Mavericks owner Mark Cuban said on social media that many technology giants, such as Google and Facebook, are calling their antitrust lawyers to ask if they can buy Twitter and get approval. Twitter is also on the phone with their lawyers to ask who could be their buyer.

Mark Cuban says Twitter may not choose to sell, but will find someone more friendly to buy Elon Musk's stock and kick him out. For the crypto community, a group of decentralized supporters should create a DAO to acquire Twitter, and in the future let token holders vote on topic trends and identity verification on social media.

However, FTX founder SBF proposed some implementation ideas for decentralized Twitter:

1. Tweets are on-chain, encrypted: The sender chooses who has access to them. If likes and retweets are also on-chain, this will force some L1s to scale to hundreds of thousands or even millions of TPS, but it will eventually happen.

2. Monetization comes in two forms: Tweet level, where the underlying protocol charges per message; UI level, which can be monetized or subsidized, for example, ads can be displayed, monetized through it, and used to pay for network fees. Each UI can have its own moderation policy, no longer is one person/company controlling speech.

3. The following can be integrated into Twitter: Tips/Payments/Monetization for Content Creators; NFTs/profiles/avatars; and DOGE .

A large number of users who advocate freedom and cryptocurrency are suggesting that Twitter move from web2 to web3, but if the huge business system of the Twitter platform is fully turned to decentralization, it will inevitably be a long process. But compared to the changes in the platform, the wealth created by Twitter in the hands of capital comes from users. Whether this can be decentralized may be what users care about after enthusiasm. It's like asking Musk if he's willing to give up his own interests and distribute the proceeds to users. I don't know what the result will be?

-

NFT project Doodles announced Friday that it has hired former Billboard executive Julian Holguin as CEO. Holguin joined Billboard in 2012...

-

Golden Finance reported that Debevoise & Plimpton lawyer Elliott Greenfield revealed that Kyle Roche may not be the only lawyer in the...